RoosterMoney *は、子供たちを経済的に「教育し、やる気を起こさせ、力を与える」ことを使命として2016年に立ち上げられました。 RoosterMoneyは、子供と親の両方が同じアカウントからポケットマネーを管理できるようにするポケットマネーアプリです。

RoosterMoneyには、3〜17歳までのすべての年齢の子供向けのさまざまなツールが用意されているため、子供は若い年齢からお金について学び始めることができます。この記事では、ポケットマネーアプリRoosterMoneyをレビューし、その仕組み、費用、およびGoHenryやOsperなどの他のポケットマネーアプリとの比較について説明します。

RoosterMoney *は、子供たちにお金について教え、経済的自立を図りながら、子供たちの経済を管理できるポケットマネーアプリです。

アカウントの設定は簡単です。フルネームとメールアドレスを入力してから、パスワードを作成するだけです。あなたはあなたの子供があなたをどのように参照しているか尋ねられます-例えば。お母さんまたはお父さん-そしてあなたがアプリで使用したい国と通貨。次に、RoosterMoneyのどの側面に最も関心があるかを尋ねられます。星図またはルースターカード-ただし、サインアップするためにこれを選択する必要はありません。

サインアップしたら、アプリで遊んで、好きな機能と嫌いな機能を確認し、必要に応じて後日プレミアムアカウントにアップグレードできます。

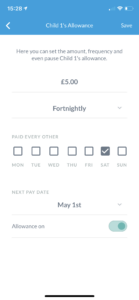

アカウントを作成すると、アプリに子供を追加するように求められます。お子様の名前、生年月日、性別をお知らせいただく必要があります。また、お子様のポケットマネーの手当と、これを毎週、隔週、または毎月受け取るかどうかを入力するオプションもあります。

最初に、作成したすべての子は、RoosterMoneyアプリの無料バージョンであるVirtual MoneyTrackerアカウントで自動的に設定されます。 RoosterPLUSまたはRoosterCardアカウントにアップグレードするオプションがあります。 RoosterMoneyで利用できるさまざまなアカウントの詳細については、ここをクリックしてください。

(クリックして画像を拡大)

RoosterMoneyには、お子様のお金を追跡できる3つの異なるアカウントがあります。以下の比較表にまとめました。

| 仮想トラッカー | Rooster PLUS | ルースターカード | |

| 年齢範囲(年) | 3+ | 5+ | 6-18 |

| 年間コスト | 無料 | £14.99(1か月間無料) | £24.99(1か月間無料) |

| 星図 | | | |

| お金を仮想的に追跡する | | | |

| スケジュールアローワンス | | | |

| マネーポット | | | |

| 子ログイン | | | |

| Chore tracker | | | |

| 金利セッター | | | |

| 無制限の保護者 | | | |

| 定期的な支払いを設定する | | | |

| Real money deposits | | | |

| Prepaid debit card | | | |

| Flexible parental controls | | | |

| Debit account details | | | |

*Currently only available in the UK

The RoosterMoney Virtual Money Tracker account is the free version of the RoosterMoney app. It is suitable for children from 3 years old and allows you to virtually track your child's pocket money. This means that no physical money is loaded onto the app, but if you give your child a regular allowance, you can keep track of how much you give them within the app.

If the child spends, saves or gifts some of their allowance, this can also be updated in the app so both you and the child can track how much pocket money has been spent or saved. You also get access to a virtual reward chart, but to use this, you'll need to set the child's currency to stars. You can then set goals for your child to work towards and reward them in stars for good behaviour to help them to achieve their goal.

The RoosterMoney PLUS account has all of the features of a RoosterMoney Virtual Money Tracker account, as well as the additional feature of a chore tracker. It is suitable for children from the age of 5 years old and allows you to set tasks for your child to complete.

As your child completes each task, they can get rewarded by earning their pocket money allowance. You can set two types of chores:allowance chores and extra earners. An allowance chore has to be completed for the child to receive their allowance, and an extra earner chore allows the child to earn additional pocket money on top of their allowance amount. To encourage saving habits, you can also set an interest rate within the app. This is a notional interest rate that is funded by the parent and can be selected within the app under the 'Save' pot settings.

Rooster Plus also allows you to set up a recurring payment within the app for things you would like your children to contribute to, such as pet food or maybe a TV and film subscription. The regular payment amount will be deducted from the child's pocket money allowance amount on the day you have chosen for the allowance to be delivered.

The RoosterMoney Rooster Card is a prepaid contactless Visa debit card that allows your child to spend and manage their own money whilst allowing you to oversee the account via the app. A Rooster Card allows parents to set daily, weekly, and monthly spending limits, as well as ATM and single transaction limits.

The debit card can also be used abroad for free, as long as transactions are kept below £50. Any transactions over the £50 limit will be charged a 3% fee. As well as getting a Rooster Card, you can also benefit from the same features included with the Rooster PLUS and the Virtual Money Tracker account.

You can choose between three RoosterMoney accounts - the free account or the two different subscription accounts. In the below table, we summarise the subscription fees and any fees associated with a RoosterCard. You can scroll down for further detail on the account limits.

| Fees | |

| Virtual Tracker | FREE |

| Rooster Plus | £1.99 per month/£14.99 per year (first month free) |

| Rooster Card | £24.99 per year (first month free)* |

| Spending online | FREE (limits apply) |

| ATM fees | FREE (limits apply) |

| Foreign transactions | FREE (limits apply) |

| Debit card loads | FREE (limits apply) |

| CHAPS transfer | £10 |

| Bank transfer OUT | FREE (limits apply) |

| Rooster Card replacement fee | £5 (1 free replacement per household) |

*Additional cards cost £19.99 each year

N.B. Rooster Cards can only be loaded by a personal account (business and Paypal accounts are not accepted).

RoosterMoney is authorised and regulated by the Financial Conduct Authority (FCA). The money held in a RoosterMoney account with a Rooster Card is ring-fenced in an account with the high street bank NatWest. The money you deposit, however, is not covered by the Financial Services Compensation Scheme FSCS should RoosterMoney go bust. However, according to its website, RoosterMoney says 'If RoosterMoney went bust, our creditors would not be able to access any of your money due to it being safeguarded. The Financial Conduct Authority would simply distribute all of the funds back to our users.'

はい。 Rooster Cards can be used abroad for chip and pin and contactless transactions. You can spend a maximum of £50 abroad for free and after this, there is a 3% charge. It is also worth considering that some foreign ATMs will charge foreign transaction fees in addition to a fee for using the ATM itself.

RoosterMoney is rated as 'Excellent' on review site Trustpilot with a score of 4.8 out of 5 stars from over 700 reviews. 88% of customers rate the app as 'Excellent', citing the app as easy to set up and navigate. Parents also comment that the app provides great motivation for their children to complete chores and better understand money. Only 2% of customers rate the app as 'Bad', citing problems with accessing the money debited on the account and technical problems with some transactions.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

RoosterMoney is just one of a range of pocket money apps available. In the below comparison table, we compare RoosterMoney to other pocket money apps from the likes of GoHenry and Osper, as well as junior bank accounts from Starling and Revolut. For more information on the pocket money apps and some of the free alternatives, read our article "The best pocket money apps".

| RoosterMoney* | Nimbl | Osper | GoHenry* | Starling Kite | Revolut Junior | |

| Eligibility (years) | 6-18 | 6-18 | 8-18 | 6-18 | 6-16 | 7-17 |

| Cost | £24.99/year (1 month free) | £28.00/year (1 month free) | £2.50/month (first 30 days free) | £2.99/month (30-day free trial) | £2/month | Free (limits apply to a free account) |

| Loading fee | Free (limit applies) | Free | 50p instant loads or free by debit card | One free load each month and 50p thereafter | Free | Free |

| ATM fees* | Free | Free | Free | Free | Free | Free |

| Fees abroad | 3% transaction fee over £50 per month | £1.50 cash withdrawals, 2.95% transaction fee | £2 cash withdrawal, 3% fee | Up to £50 per month then 3% fee | Free | Up to £250 per month |

| Instant notifications | | | | | | |

| Set spending limits |  |  |  |  | | |

| Chore tracker | | | | | | |

| Child app | | | | |  | |

| FSCS protection | | | | | | |

*Limits apply

Overall, RoosterMoney* is a great app if you are looking to teach your children about money. The free version of the account allows access to the Star Chart and Virtual Money Tracker, but the chart can easily be replicated by a simple handmade rewards chart on the fridge at home.

In addition, it may be easy to forget to update the Rooster Money Virtual Tracker allowances manually when your child spends their pocket money. Accessing the chore tracker, however, is a great way to incentivise your child to earn their pocket money and having separate logins for children allows them to track their progress on their own smart devices, further encouraging independence - though it does come at an additional cost.

The Rooster Card account offers the most benefits for a child to manage their pocket money and is a great way to allow your child to have financial independence whilst still having access to their money and control over their spending habits.

RoosterMoney is marginally cheaper than other similar pocket money accounts, but there are restrictions on how much you can spend. To find out more about the different options available for your child and their pocket money, read our articles:

リンクの横に*が付いている場合、これはアフィリエイトリンクであることを意味します。 If you go via the link Money to the Masses may receive a small fee which helps keep Money to the Masses free to use. But as you can clearly see this has in no way influenced this independent and balanced review of the product. The following link can be used if you do not wish to help Money to the Masses or take advantage of any exclusive offers - RoosterMoney.